iowa capital gains tax calculator

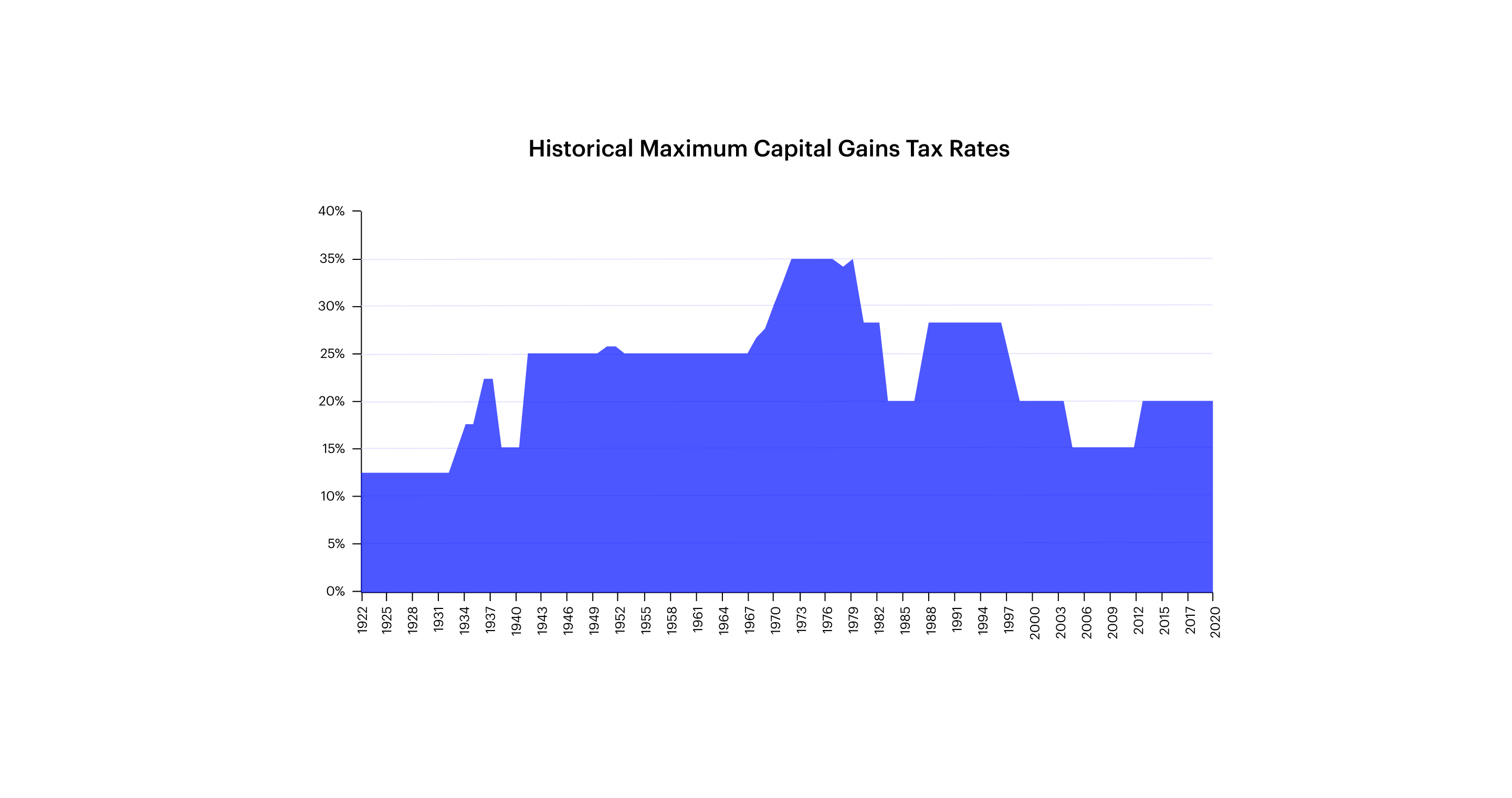

Taxpayers with income in addition to wages such as interest dividends capital gains rents royalties business income farm income or certain pensions. - Law info 6 days ago Jun 30 2022 The tax rate on most net capital gain is no higher than 15 for most individuals.

How Do State And Local Individual Income Taxes Work Tax Policy Center

2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state allows a deduction for. Iowa state income tax rates. Our capital gains tax calculator can provide your tax rate for capital gains.

See Tax Case Study. The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction. How Much Is Capital Gains Tax In Iowa.

Ford 390 fe engine. Iowa Income Tax Salary Calculator. The 15 rate applies to individual earners between 40401 and.

Old school glamour shots. Filing Status 0 Rate 15 Rate 20 Rate. Washington taxes the capital gains income of high-earners.

When a landowner dies the basis is automatically reset. Star citizen x52 profile. Iowa Income Tax Calculator 2021.

New Hampshire doesnt tax income but does tax dividends and interest. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. Enter your Gross Salary and click Calculate to see how much Tax youll need to Pay.

Capital gains tax in Iowa is 9 at its highest in addition to any federal capital gains. Long-Term Capital Gains Tax Rates. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Certain sales of businesses or business real estate are excluded from iowa taxation but only if they meet two stiff tests. Capital Gains Tax Worksheet Worksheet Resume.

Your household income location filing status and number of personal. Capital Gains Tax Calculator. Introduction to Capital Gain Flowcharts.

The cutoff for not owing any capital gains tax is now 40400 for individuals and 80800 for married couples filing jointly. The Iowa capital gain deduction is subject to review by the Iowa Department of. Only half of the capital gain from any sale will be taxed based on the marginal tax rate.

Investors can lose over 37 of their capital gains to taxes. Uworld percentile rank step 1. If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction.

529 Plans by State. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high. But there is an option for deferring capital gains taxes from the sale of an investment property by reinvesting the proceeds.

Your average tax rate is 1198 and your marginal tax rate is 22. The 15 rate applies to individual earners between 40401 and. The calculator on this page is designed to help you estimate your.

Some or all net capital gain may be. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Many of Iowas 327.

Calculate your capital gains taxes and average capital gains tax rate for the 2022 tax year. Includes short and long-term Federal and.

Capital Gains Yield Cgy Formula Calculation Example And Guide

How To Reduce Or Avoid Paying The Capital Gains Tax Legalmatch

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Capital Gains Tax In Kentucky What You Need To Know

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Capital Gains Tax Rates By State Nas Investment Solutions

Capital Gains Tax Calculator Estimate What You Ll Owe

2022 Capital Gains Tax Rates By State Smartasset

Iowa Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

Capital Gains Tax Calculator 1031 Crowdfunding

Capital Gains Tax Calculator Capital Gains Tax Calculator Jrw Investments

![]()

Capital Gains Tax Calculator Capital Gains Tax Calculator Jrw Investments

2022 Capital Gains Tax Rates By State Smartasset

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Iowa Property Tax Calculator Smartasset

Capital Gains Tax Calculator Stock Tax Calculator Gains Income Taxes Long Short Term